Corporate governance principles and structures

While setting up the corporate governance system in addition to complying with the TWSE or GTSM and other relevant regulations, the Company should establish an effective corporate governance framework besides protecting the rights and interests of shareholders, treating all shareholders fairly, strengthening the powers of the board of directors, enhancing information transparency and putting the corporate social responsibility into practice. The corporate governance framework should include:

A. Execution Principles

- Timely disclosure of material information

- Checks and balances between the board and management

- Fair representation of independent board members

- Audit Committee ensures fair and independent financial oversight

- Compensation Committee ensures sound corporate governance practices and compensation systems for directors and managers are in place

- Adoption of a high cash dividend payout policy

- Shareholders’ rights guaranteed with the right to vote on all proposals at the annual general meeting or through an electronic voting system

- Strict compliance with the Code of Ethics and Ethical Corporate Management Best Practice Principles and establishment of an internal audit mechanism

B. Implementation structure

The Company’s corporate governance structure is composed of two committees: an Audit Committee and a Compensation Committee.

1. Audit Committee:

The Audit Committee was set up in June 2013 to replace board supervisors. The committee’s operation is bound by the “Audit Committee Charter” and its main responsibility is to assist the board in overseeing the following:

2. Compensation Committee:

The Compensation Committee, established in Sep. 2011, is bound by the “Compensation Committee Charter.” The committee is responsible for evaluation of the following matters:

3. Head of Corporate Governance

The board appointed Lai Fu-Jung, the current Board Secretariat, to be the “Head of Corporate Governance" concurrently. Mr. Lai has been in charge of related stock affairs and corporate governance matters in listed company more than three years, and possess licenses of security specialist (certificate No.2250520022), stock affairs professionalism (certificate No. 3352100024), fundamental ability of internal control (certificate No. 5150126002).

Besides, the Companyis is advised to have three adequate corporate governance personnels with appropriate qualifications. a.Yi-Chien Hsu, the president of legal affairs office, possess licenses of lawyer (certificate No.11895)and fundamental ability of corporate governance (certificate No. 7930001009).

b.Chia-Ling Chang, the associate director of financial planning division, handled legal affairs, financial affairs and corporate governance affairs.

c. Ti- Chin Lee, the associate president, possess fundamental ability of security specialist (certificate No.3352200017)and fundamental ability of corporate governance(certificate No.8050004009)

It is required that the corporate governance affairs mentioned in the preceding paragraph include at least the following items:Handling matters relating to board meetings and shareholders meetings according to laws

Producing minutes of board meetings and shareholders meetings

Assisting in onboarding and continuous development of directors and supervisors

Furnishing information required for business execution by directors and supervisors

Assisting directors and supervisors with legal compliance

Reporting to the board the results of the examination on whether the qualifications of independent directors meet relevant legal regulations during the nomination, appointment, and tenure

Handling matters related to changes in directors

Other matters set out in the articles or corporation or contracts

The key points of business execution and continuing education of the company's corporate governance head for 2024 are as follows:

The key points of business execution:

1. Audit Committee:

The Audit Committee was set up in June 2013 to replace board supervisors. The committee’s operation is bound by the “Audit Committee Charter” and its main responsibility is to assist the board in overseeing the following:

- Integrity of the Company's financial statements

- Independent auditors' appointment (termination) and integrity/performance

- Internal risk controls

- Company's compliance with legal and regulatory requirements

- Company's existing and potential risks

2. Compensation Committee:

The Compensation Committee, established in Sep. 2011, is bound by the “Compensation Committee Charter.” The committee is responsible for evaluation of the following matters:

- Establish a policy, system, standard and structure for directors and managers’ compensation and review them periodically.

- Decide compensation for directors and managers and carry out periodic evaluations

3. Head of Corporate Governance

The board appointed Lai Fu-Jung, the current Board Secretariat, to be the “Head of Corporate Governance" concurrently. Mr. Lai has been in charge of related stock affairs and corporate governance matters in listed company more than three years, and possess licenses of security specialist (certificate No.2250520022), stock affairs professionalism (certificate No. 3352100024), fundamental ability of internal control (certificate No. 5150126002).

Besides, the Companyis is advised to have three adequate corporate governance personnels with appropriate qualifications. a.Yi-Chien Hsu, the president of legal affairs office, possess licenses of lawyer (certificate No.11895)and fundamental ability of corporate governance (certificate No. 7930001009).

b.Chia-Ling Chang, the associate director of financial planning division, handled legal affairs, financial affairs and corporate governance affairs.

c. Ti- Chin Lee, the associate president, possess fundamental ability of security specialist (certificate No.3352200017)and fundamental ability of corporate governance(certificate No.8050004009)

It is required that the corporate governance affairs mentioned in the preceding paragraph include at least the following items:

The key points of business execution:

- Handling matters relating to board meetings and shareholders meetings according to laws

- Producing minutes of board meetings and shareholders meetings

- Assisting in onboarding and continuous development of directors(at least 6 hours)

- Furnishing information required for business execution by directors.

- Assisting directors and supervisors with legal compliance.

- Reporting to the board the results of the examination on whether the qualifications of independent directors meet relevant legal regulations during the nomination, appointment, and tenure

- Handling matters related to changes in directors

- Other matters set out in the articles or corporation or contracts

| Date | Organizer | Course | Education hours | Total education hours |

|---|---|---|---|---|

| 2024/03/12 | Taiwan Corporate Governance Association | International Trends and Experience Sharing on Corporate Integrity Management and High-Level Accountability System | 3 | 15 |

| 2024/04/25 | Taiwan Institute of Directors | Global Economic Outlook (Inflation, Interest Rate Policies, Green Trade War) | 3 | |

| 2024/08/02 | Taiwan Institute of Directors | Corporate Governance Officer Compliance Practices | 3 | |

| 2024/09/06 | Taiwan Corporate Governance Association | 2024 Insider Trading Prevention Seminar | 3 | |

| 2024/10/26 | Taiwan Institute of Directors | Digital Innovation and Sustainable Transformation: Building Smart Enterprises | 3 |

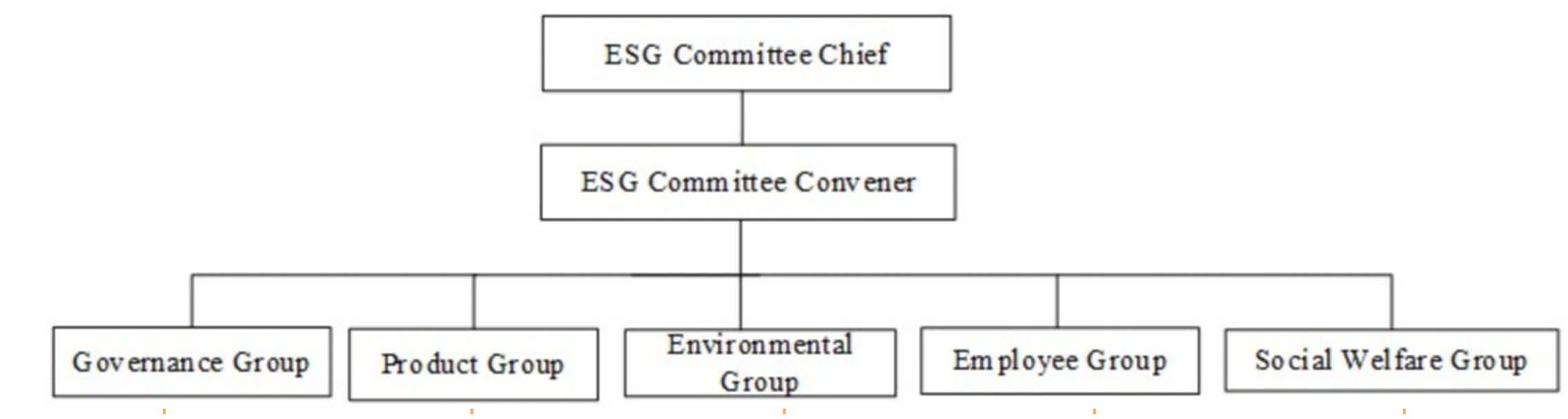

4. ESG Committee

UPEC follows the various plans and objectives announced in “Sustainable Development Best Practice” and gradually implement them within the company. The "corporate social responsibility (CSR) committee" was officially established in 2017 and renamed as the "ESG Committee" in 2022. It is chaired by the president and convened by the head of the finance group, and has five functional groups, namely corporate governance, products, environment, staff and social welfare.

ESG Committee is the central organization for company’s sustainable development. Externally, the committee reviews corporate sustainability reports; internally, it formulates corporate sustainability policies, key performance indicators for each functional group, goals, plans, and reviews implementation performance. The five functional groups under the committee operate individually, and develop corresponding plans and projects in accordance with the policies and indicators formulated by the committee, regularly control and track the implementation progress and report to the ESG Committee at least once a year. In addition to regular operation, the committee tracks the implementation progress of 16 sustainable management indicators each quarter. Also it reports to the board of directors on the current annual implementation status, key performance review and future work key plans every year, and listens to the opinions of the board of directors to make necessary adjustment and enhancement.

ESG Committee is the central organization for company’s sustainable development. Externally, the committee reviews corporate sustainability reports; internally, it formulates corporate sustainability policies, key performance indicators for each functional group, goals, plans, and reviews implementation performance. The five functional groups under the committee operate individually, and develop corresponding plans and projects in accordance with the policies and indicators formulated by the committee, regularly control and track the implementation progress and report to the ESG Committee at least once a year. In addition to regular operation, the committee tracks the implementation progress of 16 sustainable management indicators each quarter. Also it reports to the board of directors on the current annual implementation status, key performance review and future work key plans every year, and listens to the opinions of the board of directors to make necessary adjustment and enhancement.

C. Disclosure of material information

UPEC implements appropriate disclosures to ensure shareholders have up-to-date information as a basis for their investment decisions. The Company provides key operation & financial information, BOD resolutions and CEO messages in a fairly distributed and timely manner.

UPEC implements appropriate disclosures to ensure shareholders have up-to-date information as a basis for their investment decisions. The Company provides key operation & financial information, BOD resolutions and CEO messages in a fairly distributed and timely manner.